This article by Geoff Trickey, Managing Director of PCL, was first published in The Auditor.

Think for a moment about the characteristics that set you apart and give you your unique identity. Is it your cautiousness, your careful planning, your ability to generate solutions, your openness to new experiences, your flexibility, your friendliness, your professionalism, your vigilance in following things through? Or, is it your independence or that you’re highly alert to signs that things may be going wrong?

All of the above are personality characteristics, features that create a particular reputation for you amongst your friends, your colleagues and your clients. They also define your risk disposition. PCL’s research has found 23 different personality themes that impact on risk taking and these contribute in some way to our taxonomy of eight distinctive Risk Types. It seems that these risk-related personality characteristics have a lot of influence on the way you come across to others, your public persona or your reputation. They also impact on the way people will see eye to eye when making decisions and in the ease and comfort of relationships between colleagues. Individuals with opposite Risk Types are very different. When both people are extreme examples of their Risk Type, they may seem like aliens to each other, almost beyond belief, so not too likely that they will always see eye to eye or easily get along.

The interesting thing is that these distinct and defining features are invisible. In a crowded train you can have no idea who, among all the people around you, would be which of the eight Risk Types. Some will be highly anxious in these crowded conditions, some will be relaxed, unstressed and oblivious to the circumstances, some will be excited by being ‘one of the crowd’ and find interest and fascination in the diversity of all those around them, others will be fretting about timetables, next appointments, whether they might miss their connection in this slow moving crowd, but all that is inside their heads. You would not know it, you might not want to know it, but it’s real and it’s there. If you had a grasp of the key features of each Risk Type, you would be able to make a reasonable guess about the people you know well; certainly you would recognise how they fit the description in their Risk Type report. Yet, these unseen individual differences play a huge part in influencing behaviour across all areas of life; recreational preferences, the way you manage money, plan your career, arrange your holidays. Their interpersonal consequences also create the group dynamics in teams and impact on group decision making. Organisational culture, board decisions, managerial relationships, and recruitment decisions are all influenced through the crucial overall balance achieved between opportunity and risk. Organisational survival depends on it. Yet risk dispositions are invisible and likely to go unrecognised. The Risk Type Compass® is a psychometric personality questionnaire that focusses on these critical risk features. Like other personality characteristics, they have a persistent influence on our behaviour and on all our decisions.

A recent research study by eminent economists tracked senior bankers over a 15 year period as they moved from job to job. They found that the risk taking policies of a bank were determined more by the personality of the bankers in charge that any other measurable factor, including bonuses (Financial Times, 2016). This has implications for Auditors too. Auditing is more about probability than about certainty. It involves investigation, observation and interpretation. The information gathered has to be pulled together and formulated in order to achieve coherent conclusions and recommendations. In all of this, personal judgements play a very significant part. The recommendations of one auditor may not be quite the same as another. Risk dispositions influence the perception of risk and the way we think about it and handle it; so there is always a degree of subjectivity and bias in the judgements that we make.

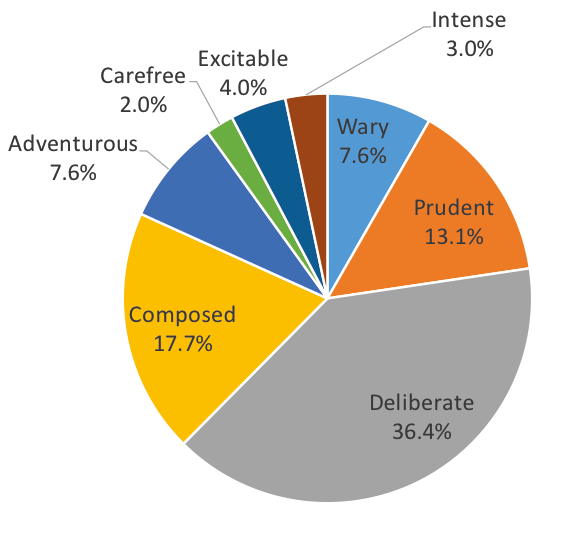

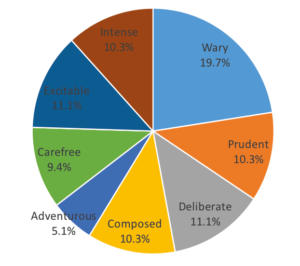

The big picture is that, as a profession, Auditors tend to be relatively risk averse by nature although, within this trend, there is considerable variability. This is illustrated in Figure 1. which shows how a large international sample of Auditors were rated using the Risk Type Compass®. This positions any individual within a 360o spectrum calibrated continuously through the eight Risk Types which merge and blend into one another. 67% of Auditors fall within a range defined by three neighbouring Risk Types. Clearly, like any other professional, the approach and manner of an individual auditor will be influenced by their own risk disposition, and so will their judgements and decisions. You will probably know of Auditor colleagues who are somewhat either more or less cautious than you are. Everyone falls somewhere on the Risk Type Compass®, and this positioning will have implications. There are no good or bad Risk Types; each has its advantages and disadvantages. The important thing is to be sufficiently self-aware of the bias that these differences in risk disposition imply. This allows the benefits to be exploited and the disadvantages to be managed in a professional way.

Figure 1: AUDITORS

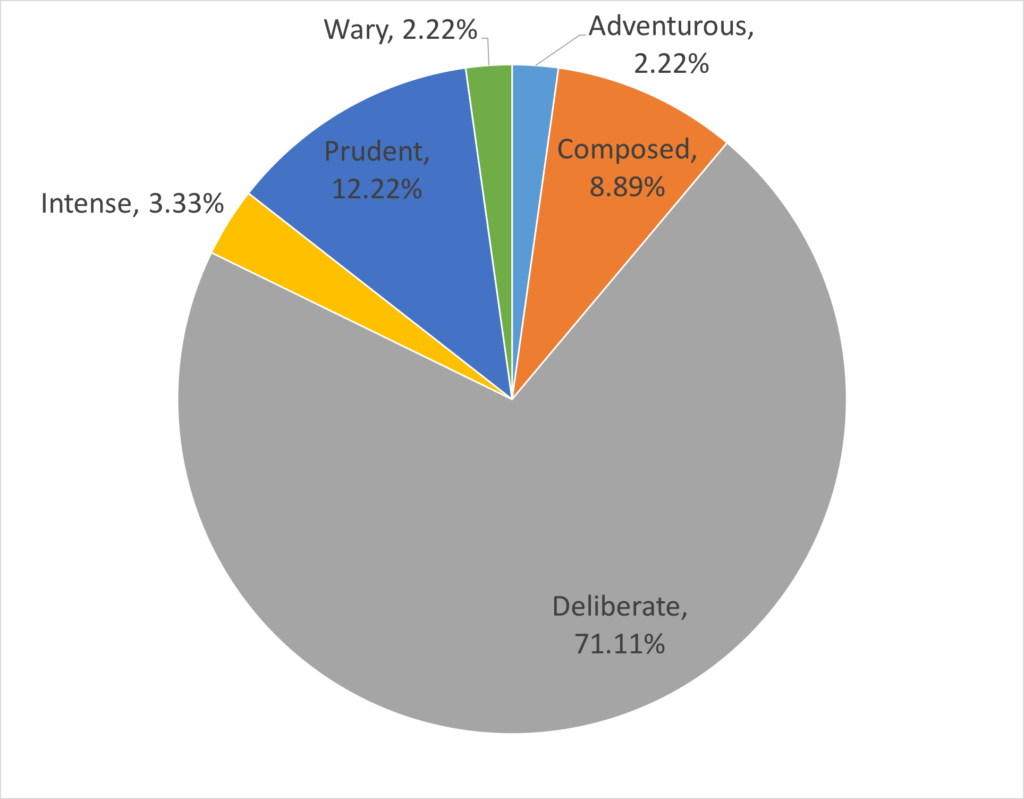

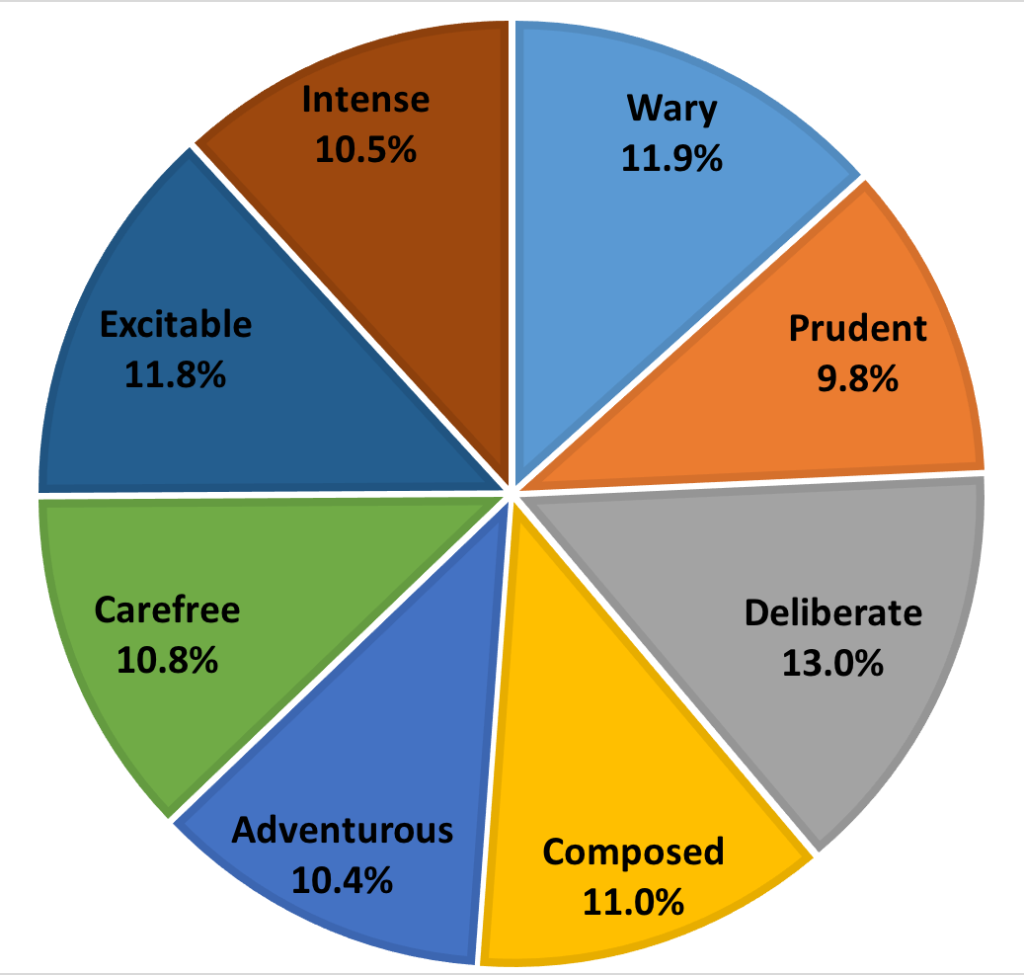

But self-awareness is just one side of the coin. There is a second way in which Auditors encounter Risk Type. Auditors work in many different sectors and with many different professions. Just as there is a characteristic distribution of Risk Types amongst auditors, so there is with other professions. Police officers do not, in general, have the same risk dispositions as recruiters or air traffic controllers (Figure 2). Not all professions are so distinctive in this respect and some have a very even distribution of the eight Risk Types but in others, and air traffic controllers are an extreme example, the influence on the culture within that industry or profession will be palpable. Walk into the tax department of an accountancy firm and the likely reaction is no more that a peek over the top of a pair of spectacles; walk into a PR firm and they will probably be climbing over the desks to grab your hand and to introduce themselves.

Figure 2: AIR TRAFFIC CONTROLLERs

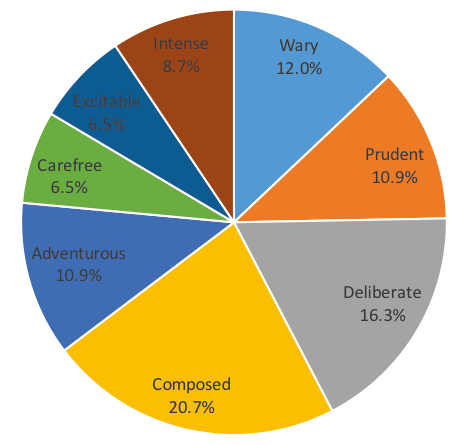

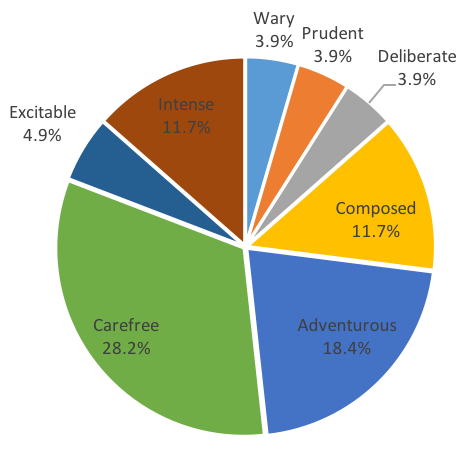

In moving between organisations, or between departments in a large organisation, these differences in organisational culture will create two challenges for the Auditor. Firstly, to engage with those that need to be engaged with, the Auditor may need to adapt their approach and their mind set. To establish working relationships, carry out their enquiries, communicate, define their requirements and see the project through they negotiate the potential pitfalls of dealing with people whose risk disposition may be very different from their own. Organisations are characterised by different risk dispositions (see Figures 3 to 6) and, within any organisation, the finance function will be very different in this respect to the sales department and HR will be different to R&D. When the risk culture of an organisation is very distinctive and very different to the risk disposition of the Auditor, basic assumptions about acceptable levels of risk and uncertainty, about vigilance in dealing with a task, maintaining records or completing formalities may threaten the successful completion of the audit, or its effectiveness. An awareness of the possible implications of Risk Type in the individuals you are working with, as well as self-awareness about the inevitable bias inherent in your own risk disposition, will improve your ability to navigate successfully within a world where these individual differences can be quite extreme.

From our database of over 7,000 administrations of the Risk Type Compass® assessment we have generated the following illustrations of the varied patterns of Risk Type in different work settings:

Figure 3: ENGINEERS

Figure 4: RECRUITERS

Figure 5: IT PROFESSIONALS

Figure 6: POLICE OFFICERS

Figure 7: GENERAL POPULATION

Looking at the total sample graphic (figure 7), it is clear that Risk Types are very evenly distributed. Your next encounter is no more likely to be any one than any other. Surely, this even distribution must reflect the importance of all the Risk Types in contributing to survival for our own species? We clearly need those that are ‘on edge’ about risk who will draw attention to pending disasters and help to protect us. Species survival also needs those who will challenge everything in search of better solutions or who are prepared to face the danger and act to overcome it. I refer to this even distribution of Risk Types as ‘Team Homo Sapiens’. No football game is won with a team made up solely of defenders or solely of attackers; you need a balance between the two. There are no ‘good’ or ‘bad’ Risk Types; all have an important contribution to make. Once you can measure it, you can begin to manage it effectively. Team building of all kinds and at all levels can make use of it. The challenge is to find the right combinations of Risk Types to ensure success. Individuals will improve their effectiveness, their decision making and their performance by taking their own Risk Type dispositions into account.

These findings are already influencing policy decisions and working practices in a wide range of occupations and in different countries. The research is robust and the possibilities and opportunities are becoming ever more apparent. In Auditing too, these human factors are an unavoidable feature of the terrain.

What Risk Type are YOU?