Are risk takers more likely to be self-employed? Authored by Dr. Simon Toms

Why do people choose to be self-employed? Responses to this question will vary, but you will often hear answers like:

- Wanting to be your own boss

- Creative freedom

- No two days the same

- Greater control over working hours and work-life balance

- Choice of who you work with and for

- You can choose where you work

Some people will find these reasons compelling. The opportunity to work unsupervised outside an organisational structure may feel exhilarating and liberating. For others, the increase in risk and uncertainty will prove too daunting. As personality psychologists, we were interested in the following question: Are there elements of personality that predict these preferences and influence the decision to pursue self-employment? Research indicates a resounding ‘yes’!

Chan et al. (2015) recruited two Undergraduate samples to explore whether personality could predict those who are motivated or aspire towards entrepreneurial careers. The analysis incorporated risk-related traits, the Big Five, and a ‘proactive personality’ construct that assesses the tendency to identify opportunities, take initiative, and persevere in efforts to change one’s environment in a manner that is ‘‘unconstrained by situational forces’’.

The analysis found that risk-related traits, the Big Five (primarily Openness to Experience and Extraversion), and proactive personality were all found to predict participants’ desire for entrepreneurial careers. Conversely, increased risk aversion predicted reduced interest in an entrepreneurial career path.

Research like this provides an intriguing insight into the aspects of our personality that are likely to predict a desire to be self-employed. However, reliance on student samples can limit generalisability to working populations. Will these findings translate to the working population?

This leads to the current study that sought to explore the interaction between personality and self-employment. Researchers at PCL analysed data collected from a large and diverse sample of the working population using the Risk Type Compass to determine whether personality could predict self-employed status.

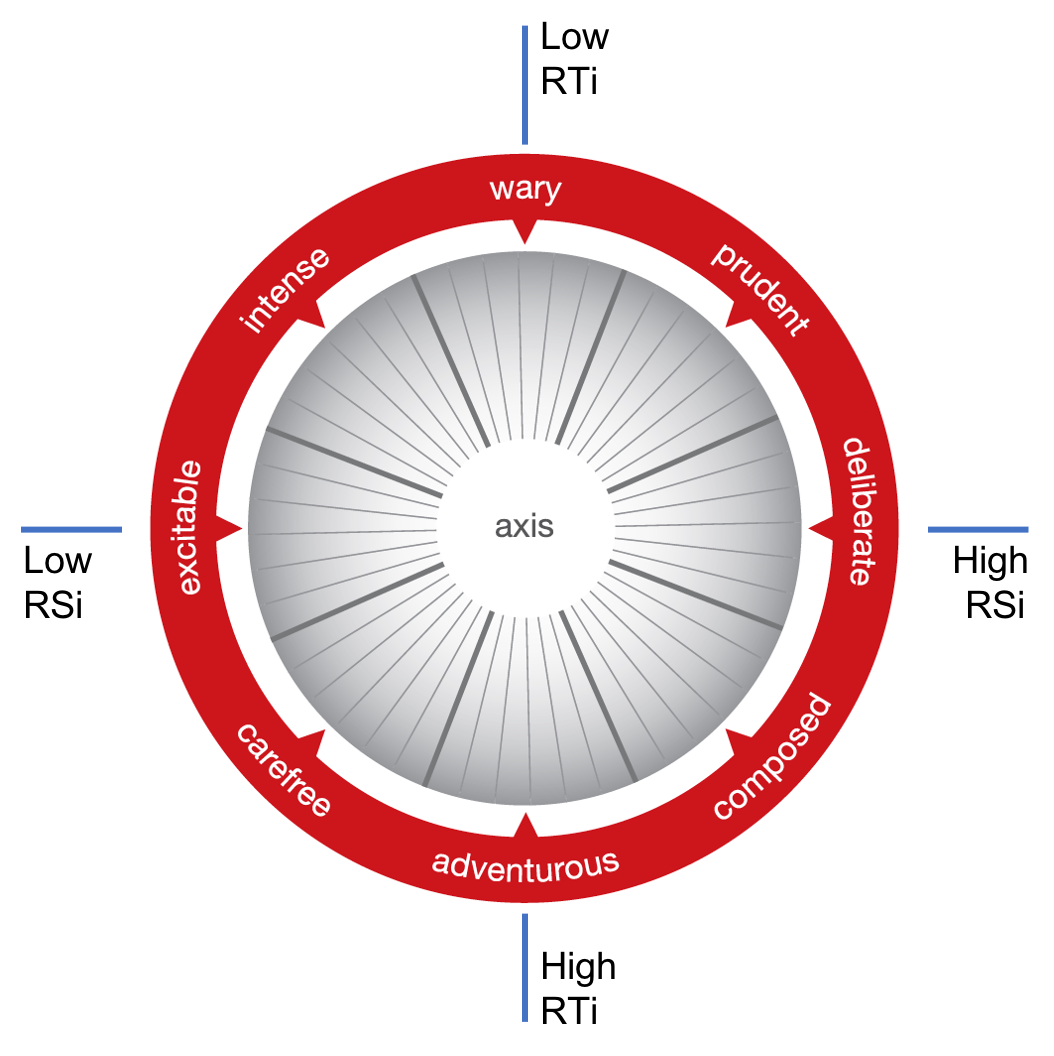

The Risk Type Compass is a personality assessment that evaluates differences in the way individuals perceive, react to and manage risk. It uses participants’ responses to place them in one of eight ‘Risk Types’ (or an ‘Axial’ group). Each Risk Type encompasses distinctive characteristics that can have sizeable ramifications for how we think and behave. An important point is that these Risk Types have a relatively even distribution across the adult population. The RTC is built on two key axes: the vertical Risk Tolerance Index (RTi) and the horizontal Risk Stability index (RSi). Figure 1. below presents the RTC model.

Figure 1. The Risk Type Compass

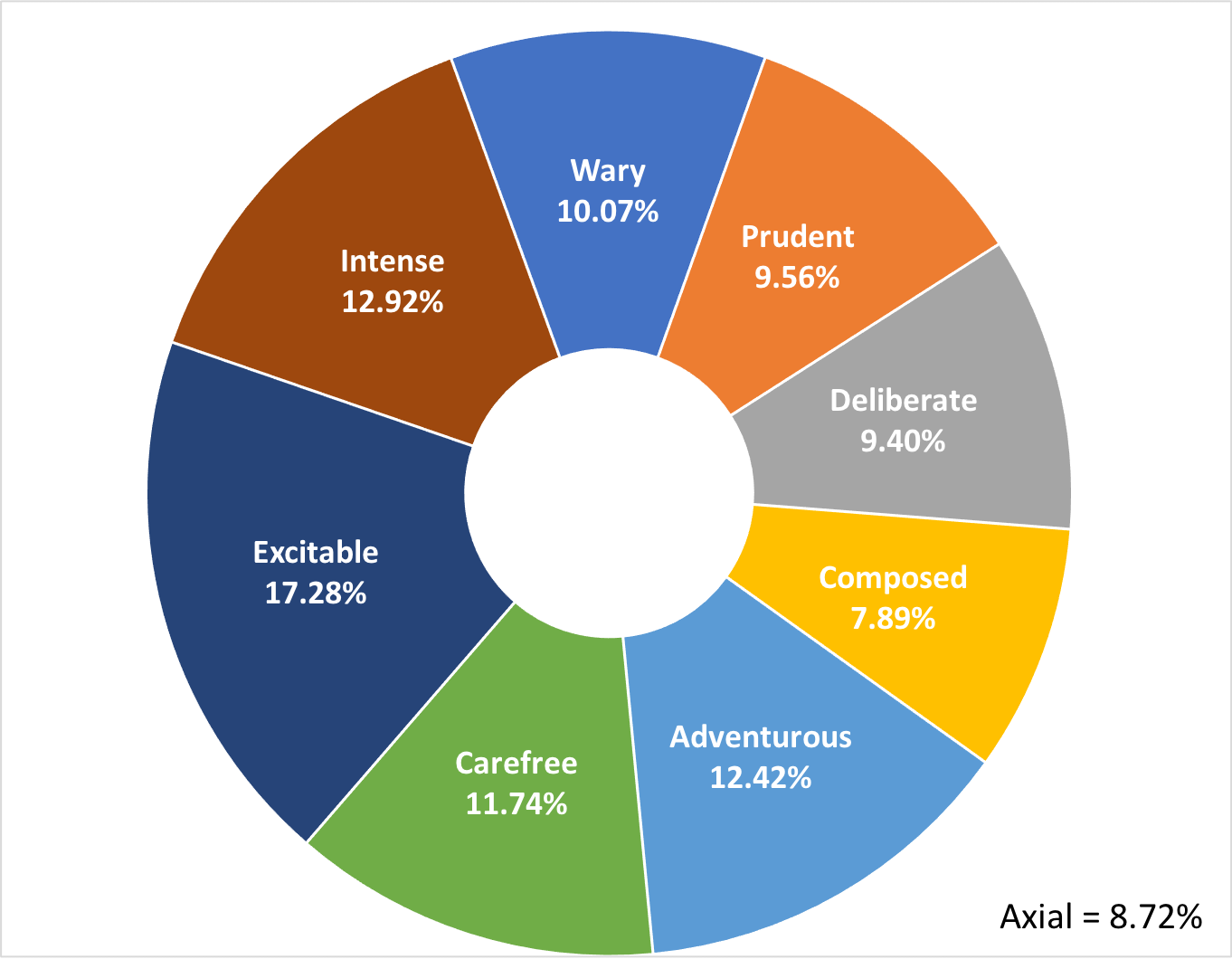

Analysis focussed on an initial sample of 20k participants from the working population who had completed the RTC. Of these participants, 596 individuals identified themselves as ‘Self-Employed’. Findings from the initial analysis indicated an interesting Risk Type distribution for this self-employed group, illustrated in Figure 2. below.

Figure 2. Risk Type distribution of Self-Employed participants (N = 596)

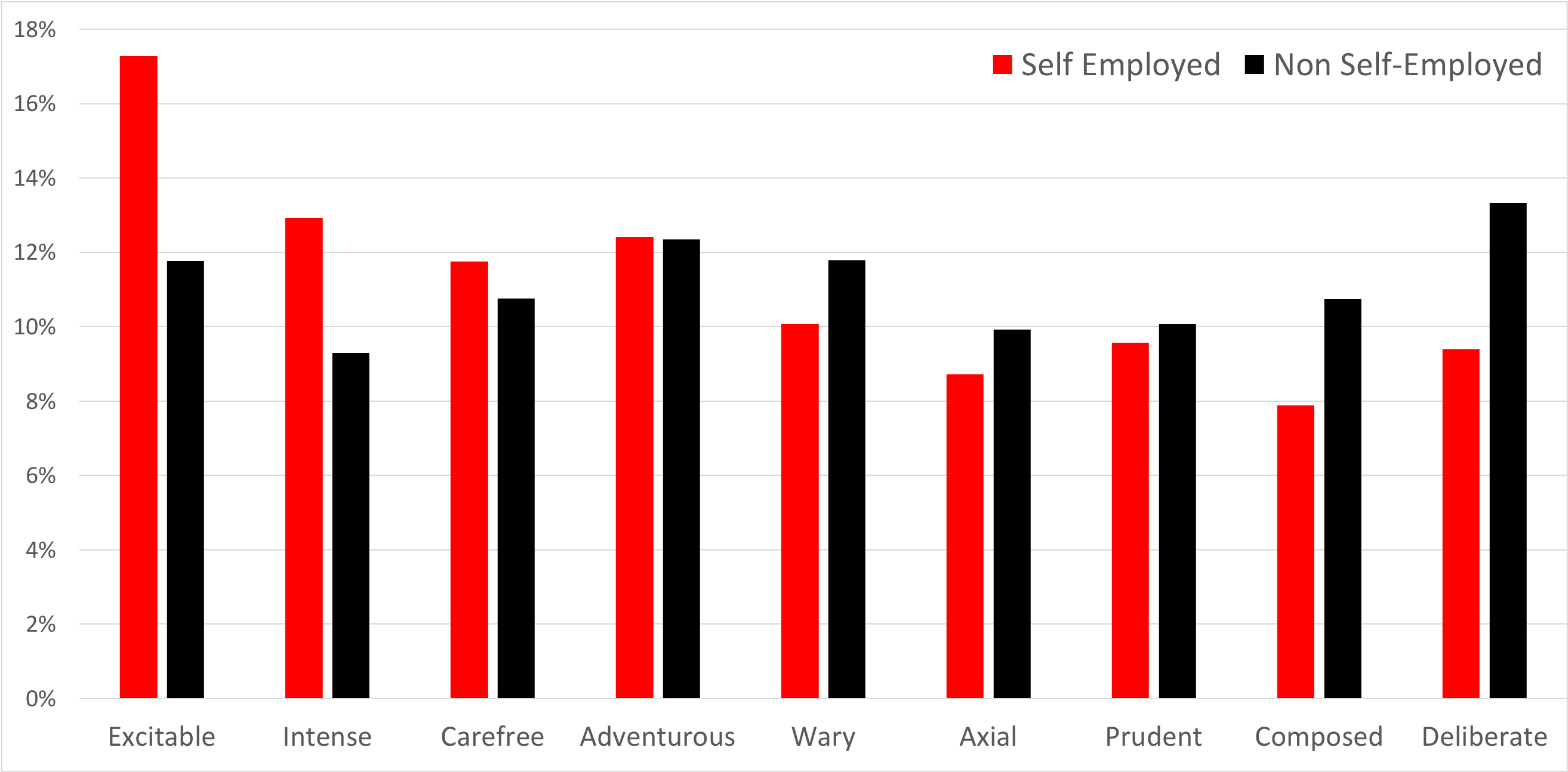

Analysis indicated a greater propensity of Risk Types positioned towards the ‘low RSI’ side of the compass, with Excitable, Intense and Carefree the most represented respectively. This finding is also illustrated with a direct comparison to the Risk Types of over 19k ‘non self-employed’ participants in Figure 3. below. Risk Types are ordered from low-to-high RSi.

Figure 3. Risk Type Distribution between Self-Employed and Non-Self-Employed

The outcomes of the analyses provide interesting distinctions between the two worker samples. Excitable Risk Types were approximately 50% more likely to be found in the self-employed sample compared to the non-self-employed sample. This distinction was also significant at the scale level, with Risk Types placed at the lower end of the Risk Stability Index also over-represented. In the context of decision making, lower RSi scores indicate a desire for greater variability and flexibility, whilst higher RSi scores suggest a personal preference increased consistency and predictability.

This is particularly prevalent in Excitable Risk Types. Depending on the mood of the moment, they may enjoy the spontaneity of making unplanned decisions. Not being planful or well organised, there is a danger that such people may not take the trouble to check things out in their enthusiasm to embrace a new undertaking. When viewed in conjunction with self-employed preferences, it is easy to understand why they would be less inclined to work in the more restrictive and regimented ways that will often come from managerial supervision and adherence to organisational hierarchy.

In contrast, Deliberate Risk Types will be characterised by a higher propensity towards due process and compliance. Previous analyses of this Risk Type has indicated over-representation in job roles and industries heavily reliant on following rules and procedures. The most significant example of Deliberate Risk Type over-representation was found in a sample of Air Traffic Controllers. Analysis of over two hundred ATC’s identified over 70% to be Deliberate, compared with approximately 14% of the general population, with nearly all remaining participants in the high-RSi Risk Types of Prudent and Composed. Equally notable is the fact this sample of over two-hundred ATC’s contained zero Excitable Risk Types.

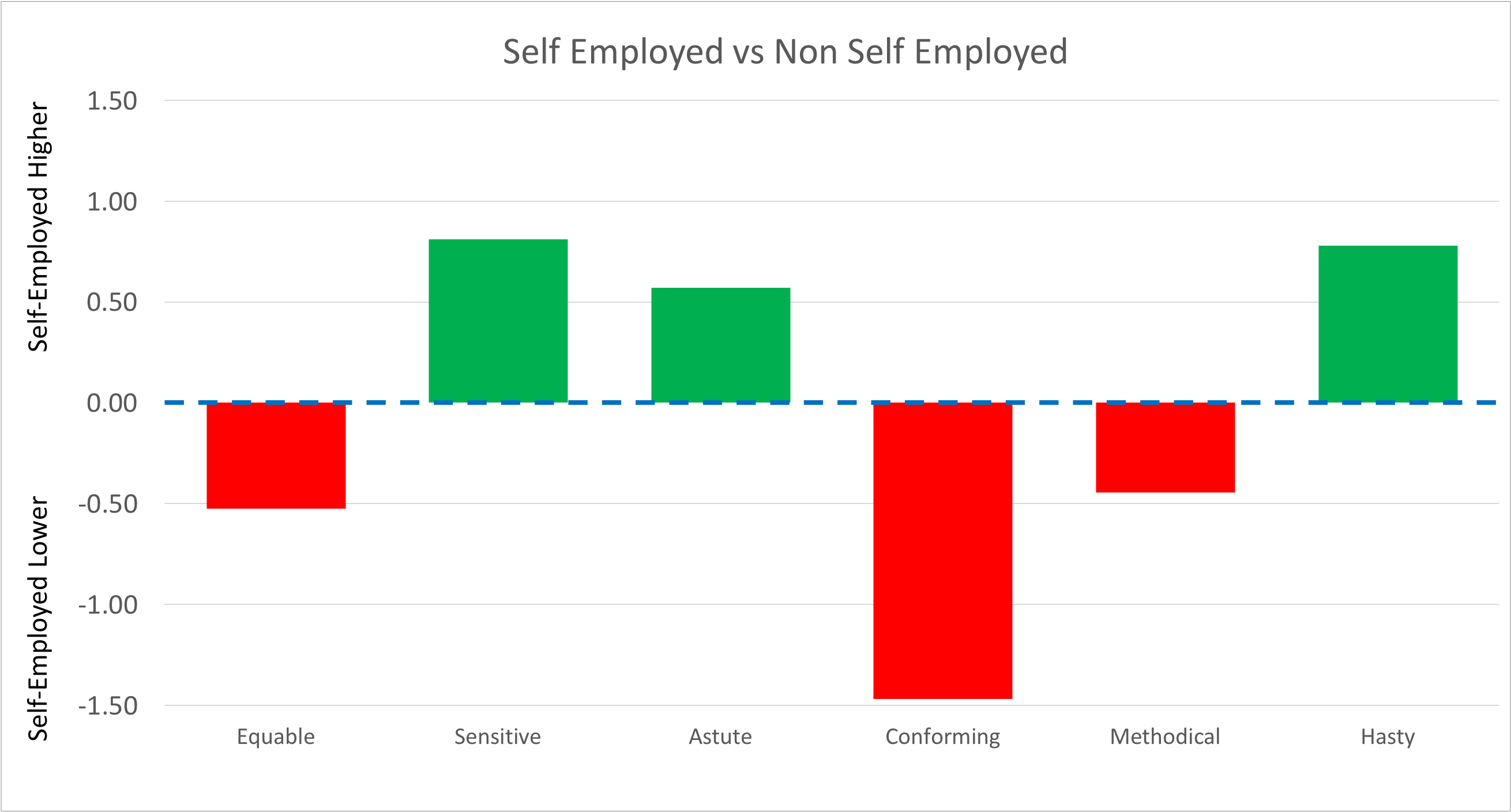

The RTC is generated using information from twenty personality-based ‘subthemes’ that combine to calculate an individual’s Risk Type. Further analysis at this level can provide supplementary insight into the distinctiveness of the self-employed group. Figure 4. below illustrates the largest subtheme differences between the self-employed and non-self-employed workers.

Figure 4. Subtheme variations between the self-employed and non-self-employed groups

Unsurprisingly, the largest difference between the two groups occurred on the ‘Conforming’ subtheme. High scorers will typically abide by rules, respect superiors, and adhere to the status quo. In contrast, low scorers are more likely to find rules and procedures irksome and may look for workarounds when possible.

In conclusion, personality has a clear impact on the preference for being self-employed. Risk Types higher on the Risk Stability Index are more likely to have a preference for the stability that organisations provide and a greater need for ‘permission to act’ that can be fulfilled by managers and supervisors. In contrast, Risk Types lower on the RSi are more likely to crave the flexibility and autonomy afforded by self-employment and may be more negatively impacted in job roles that fail to provide this.

Understanding these personality-driven propensities may shed light on professional discomfort and identify alternatives more strongly aligned with individuals’ underlying tendencies and preferences.

References

Chan, K. Y., Uy, M. A., Chernyshenko, O. S., Ho, M. H. R., & Sam, Y. L. (2015). Personality and entrepreneurial, professional and leadership motivations. Personality and individual differences, 77, 161-166.

Have you heard about our upcoming conference?

How can we optimise decision making in uncertain times? The Sagacity Conference brings together influential thought leaders for discussion about the nature of risk and uncertainty and the implications of our understanding of those concepts for high stakes decision making